- SMALL BUSINESS INCOME AND EXPENSE TEMPLATE SOFTWARE

- SMALL BUSINESS INCOME AND EXPENSE TEMPLATE DOWNLOAD

HMRC regularly updates these figures, and you will need to check back if there is a new version of the template with new rates.

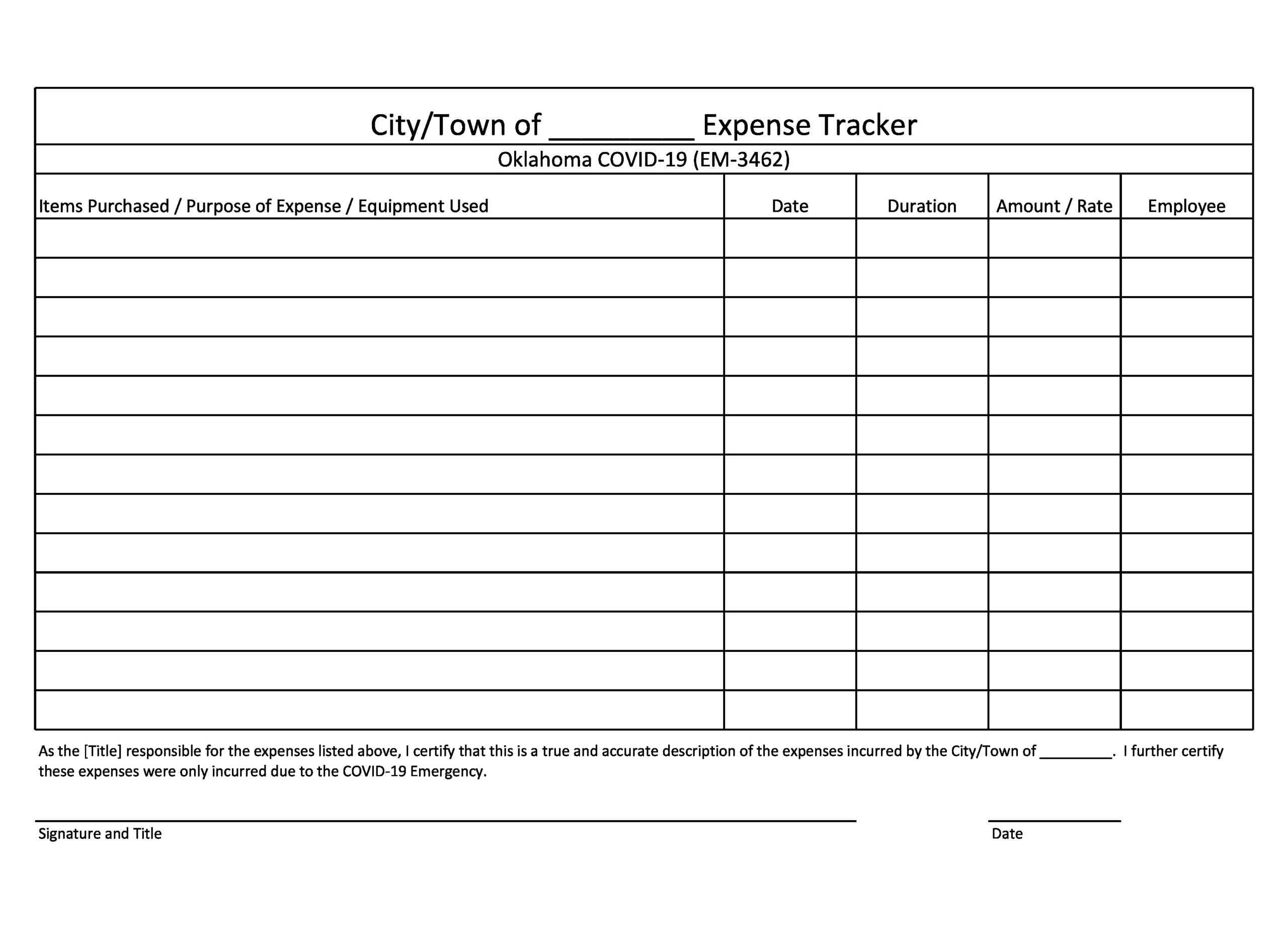

This amount varies depending on fuel type and engine size. If you are VAT registered and claiming mileage at 45p per mile, you can only claim part of the amount as VAT. Excel Expenses Claim Form Template UK – VAT Mileage Each expense will need a separate line if you have a receipt to claim with several different expenses then, you will need a line for each type. The templates are created to calculate all the figures for you this is especially useful for VAT registered.Ĭomplete the section on the top right, including name, date and, if needed, authorisation signature.

SMALL BUSINESS INCOME AND EXPENSE TEMPLATE DOWNLOAD

Your time is worth more than $9.99 for the 4- 20 hours you might spend putting this together.Free spreadsheet download below Instructions for Business Monthly Expense Template Example Expenses Spreadsheet UKĭownload the correct template below, depending on if you are registered for VAT or not. You might ask yourself, why purchase a spreadsheet that I could possibly create myself? I’ll tell you why, for $9.99 is it really worth your time? I have done all the formatting, put together all the sheets, calculated all the formulas and put it all together in a clean and beautiful spreadsheet, all ready to use “out of the box” per say. Let’s face it, when it comes to your business whether big or small, time is valuable.

SMALL BUSINESS INCOME AND EXPENSE TEMPLATE SOFTWARE

If your looking for a simple bookkeeping software or spreadsheet for your business and are not interested in paying a lot of money, this is for you. If you would like to change one of those categories you can! Just go to the “settings” tab and customize your categories to your liking. I have built in categories for sales and expenses. All the formulas are built in, all you have to do is input your data.ĥ. It also sends that information to your dashboard so you have a simple way to see how your business is doing. It will calculate your profit loss for the month and display it at the top of the sheet. Monthly Sales and Expenses: There is a tab for each month where you can input your monthly sales and expenses. It tells you what date you went, where you went, and how many round trip miles it took to get there and back.Ĥ. The miles tab allows you to keep track of all those miles. Miles: When you drive anywhere for business, whether it be to pick up inventory, supplies, or to just have a business meeting, all those miles driven can be written off at the end of the year. It also tells you which categories you have spent the most in. Lets you know how many miles you have driven for a business purpose, so you can write off your miles at the end of the year. Dashboard: The dashboard keeps you up to date on your yearly and monthly sales and expenses. The layout is not cluttered and all over the place like most bookkeeping spreadsheets out there.Ģ. What will you find in this spreadsheet?ġ.

It is a very beautiful, clean design, easy to read and understand. This one spreadsheet can accommodate your simple Small Business Bookkeeping needs.

I have spent many hours putting this spreadsheet together to offer a simple bookkeeping solution for all online sellers just like me. Income and Expenditure Template for Small BusinessĬompatibility: Microsoft Excel versions 2007 and up

0 kommentar(er)

0 kommentar(er)